If you’ve ever scanned the fine print on a credit card offer, you’ve likely come across a percentage labeled as the card’s APR — but what does APR mean, and why should you care? APR, or Annual Percentage Rate, plays a major role in determining how much interest you’ll pay if you carry a balance. Understanding hOw, credit card APR works are crucial, especially if you don’t plan to pay off your balance in full each month. The higher the APR, the more your debt can grow over time.

What is APR?

The Annual Percentage Rate (APR) represents the actual cost of borrowing on a credit card. It’s the yearly interest rate you’ll pay if you carry a balance from month to month, and it may also include specific fees tied to the account. Credit card APRs can vary widely depending on the issuer and your credit profile — for instance, one card might offer a low APR of 9.99%, while another charges 14.99% or more. Knowing your APR helps you estimate how much interest you’ll pay over time, making it a key factor in choosing the right credit card.

How does APR work?

When you carry a balance on a credit card, interest charges typically apply — and that’s where the Annual Percentage Rate (APR) comes in. Credit card issuers use your credit score to determine your APR; in general, a higher credit score means a lower APR, helping you save on interest over time. Lower APRs are more favorable, as they reduce the cost of borrowing.

However, you won’t always have to pay interest. Most credit cards offer a grace period, allowing you to avoid interest charges if you pay your entire balance by the due date of each billing cycle.

APR on Cash Advances

Using your card for a cash advance is different. These transactions typically come with higher APRs and additional fees, making them significantly more expensive than standard purchases. Interest on cash advances often begins accruing immediately—there’s usually no grace period.

Fixed vs. Variable APR

Most credit cards come with a variable APR, which can change over time. These rates are often tied to the prime rate — a benchmark interest rate used by banks. If the prime rate increases, your card’s APR will likely rise as well. Conversely, if the prime rate drops, your APR may decrease.

In contrast, a fixed APR stays the same for the life of your account. While fixed-rate credit cards offer more predictability, they’re less common and may come with other trade-offs, such as fewer rewards or stricter approval requirements.

What is a good APR for a credit card?

A good APR on a credit card depends on your credit profile and the type of card you’re applying for. While a 0% APR is ideal, it’s typically only available through introductory offers or promotional periods — and it doesn’t last forever. Once the promotional period ends, the regular APR kicks in, which can vary widely.

To assess whether an APR is competitive, compare it to the average APR for your credit score range. For example:

- If you have excellent credit, a good APR might be around 12% or lower.

- For those with good or excellent credit, an APR of nearly 20% can be considered favorable.

- If your credit score is fair or poor, an APR of 25% or below may be standard.

Regardless of your credit score, the general rule holds true: the lower the APR, the less interest you’ll pay—and the better the deal.

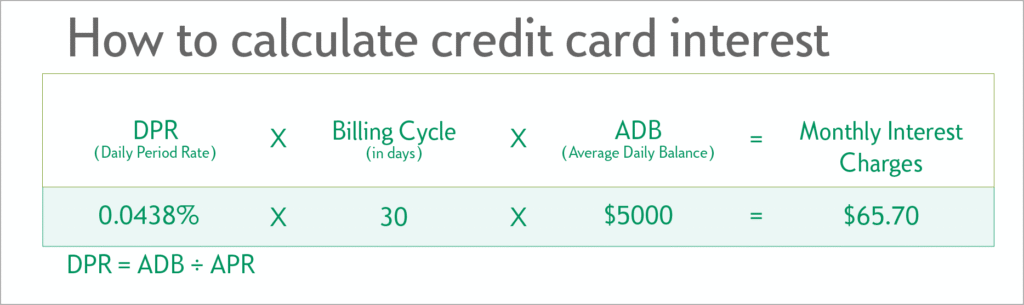

How to calculate APR?

Knowing your credit card’s APR helps you estimate how much interest you’ll owe if you carry a balance. To do this, you’ll first need to calculate the daily periodic rate — the amount of interest your balance accrues each day.

Here’s a step-by-step example using a $1,000 balance and a 20% APR:

Convert the APR to a daily rate:

Divide the APR by 365 (days in a year):

20% ÷ 365 = 0.0548% per day.

Apply the daily rate to your balance:

0.0548% of $1,000 = $0.548 per day, or about 55 cents daily.

Calculate interest for the billing cycle:

Multiply the daily charge by the number of days in your billing cycle.

For a 27-day billing cycle:

$0.55 × 27 = $14.85 in interest for the month.

So, on a $1,000 balance at 20% APR, you’d pay roughly $14.85 in monthly interest if you don’t pay off the balance in full. Understanding this calculation can help you make smarter decisions about managing your credit card debt.

Types of APR

Not all credit card APRs are the same — in fact, your card may apply different APRs depending on how you use it. Whether you’re making a purchase, transferring a balance, or withdrawing cash, it’s essential to understand the type of APR you’re being charged to avoid costly surprises.

Purchase APR

This is the standard APR applied to everyday purchases when you carry a balance past your due date. It’s the most frequently used APR on most credit cards.

Cash Advance APR

When you use your credit card to withdraw cash, you’re typically charged a much higher APR, often without a grace period. Interest on cash advances begins accruing immediately, making this one of the most expensive ways to use your credit card.

Balance Transfer APR

If you move a balance from one credit card to another, you’ll often be charged a separate APR for the transferred amount. Many credit card issuers offer a lower promotional APR on balance transfers to attract new customers.

Promotional or Introductory APR

Some cards offer a 0% introductory APR for a limited period—usually on purchases, balance transfers, or both. These promotional rates typically last 6 to 18 months before reverting to the card’s standard APR.

Penalty APR

If you miss payments or violate your card’s terms, you could trigger a penalty APR, which is significantly higher than your regular purchase APR. To avoid penalty rates, always pay on time — setting up automatic payments or alerts can help.

Always Read the Fine Print

Before applying for a new credit card, review the card’s terms and conditions carefully. Look for the APR and fees disclosure table, which clearly lists the types of APR, the card charges, and when they apply. Understanding these details can help you choose the most cost-effective credit card for your needs.

APR vs. APY

While APR (Annual Percentage Rate) reflects the cost of borrowing money—such as the interest you owe on a credit card balance—APY (Annual Percentage Yield) shows how much you can earn from an interest-bearing account, like a savings account or CD.

Both are expressed as percentages, but they serve opposite purposes:

- APR tells you how much you’ll pay when borrowing.

- APY shows how much you’ll earn when saving.

APY takes into account not just the interest rate but also the frequency of compounding, which can significantly boost your overall earnings. While a low APR is ideal when using credit, a high APY is what you want when building savings, as it helps your money grow faster over time.

How to lower your APR on a credit card

While you may not always have control over your credit card’s APR, there are innovative strategies you can use to reduce what you pay in interest:

Improve Your Credit Score

Credit card issuers typically offer lower APRs to customers with higher credit scores. To boost your score:

- Make all payments on time.

- Avoid opening multiple credit accounts at once.

- Pay down existing debts.

- Bring any delinquent accounts current.

Improving your creditworthiness over time can help you qualify for better interest rates on your current or future cards.

Open a Balance Transfer Credit Card

Many credit card companies offer promotional 0% APR on balance transfers for a limited time. If you’re carrying a balance on a high-interest card, consider transferring it to a new card with a low or 0% introductory APR. This can give you time to pay down your debt without additional interest piling up.

Avoid Carrying a Balance

While this won’t lower your actual APR, paying your balance in full each month means you won’t owe any interest. Most cards offer a grace period on new purchases, so if you consistently pay in full and on time, you can avoid interest charges altogether, regardless of your APR.

The bottom line on APR

Before using any credit card, it’s essential to review the terms and conditions, including the different types of APRs your account may carry. Keep in mind that interest is only charged if you have a balance. By paying off your entire balance before the end of each billing cycle, you can avoid interest charges altogether and use your card more strategically.

Choosing the right credit card doesn’t have to be complicated. Explore our full range of credit card options designed to match your financial goals — whether you’re looking to earn cash back, take advantage of low introductory APRs, or transfer a balance from another card. Find the credit card that fits your lifestyle and puts you on the path to smarter spending.

Frequently Asked Questions

What does APR mean on a credit card?

APR (Annual Percentage Rate) is the yearly interest rate you’ll pay on credit card balances if you don’t pay them in full each month. It reflects the cost of borrowing money, not including compounding.

How is credit card APR calculated?

To calculate interest, divide the APR by 365 to get the daily periodic rate, then multiply that by your daily balance and the number of days in the billing cycle.

Can I avoid paying APR on a credit card?

Yes. Thanks to the card’s grace period, you can avoid paying interest entirely if you pay your full balance before the due date each month.

What’s the difference between APR and interest rate?

APR includes the interest rate plus any additional fees (like annual fees or balance transfer fees), giving a more complete picture of the cost of borrowing.

Why do credit card APRs vary by user?

Card issuers set APRs based on your credit score, income, and payment history. Better credit typically earns you lower APRs.

Can a credit card APR change over time?

Yes, most credit cards have a variable APR tied to an index like the prime rate. As the index changes, your APR can go up or down.

How can I lower my credit card APR?

Improve your credit score, negotiate with your card issuer, or consider transferring your balance to a card with a lower or 0% introductory APR.

Conclusion

Understanding your credit card’s APR is essential to managing your finances wisely. Whether you’re making purchases, transferring balances, or taking cash advances, the APR determines how much interest you’ll pay if you carry a balance. While a low APR can save you money over time, the most innovative strategy is to pay off your entire balance each month to avoid interest altogether.