Joe Biden’s projected victory points toward a possible era of significant economic transformation. His administration is expected to prioritize pandemic response, expansion of domestic health care, modernization of national infrastructure, and the adoption of expansionary fiscal policies—key factors set to shape the U.S. economic landscape over the next two years. However, the ultimate scope of change hinges on the outcome of the Senate, currently awaiting the results of two critical runoff elections in Georgia.

While the emergence of a potential COVID-19 vaccine, anticipated to be distributed over the next 12–24 months, could reduce the volume of fiscal aid required in 2021, a surge of new economic proposals is still expected early next year.

If Democrats secure control of the Senate, fiscal spending will likely surge beyond any proposed tax increases, necessitating additional deficit financing to support ambitious fiscal and social programs. A Biden administration is also poised to champion regulatory reforms and labor-focused policies that prioritize worker interests over capital.

Conversely, if Republicans retain Senate control, Biden’s policy agenda would be significantly constrained. Tax and regulatory reforms would likely stall, with efforts concentrated mainly on pandemic response and limited bipartisan measures.

Washington insiders suggest that a 50-50 Senate split would lead to shared power rather than complete Democratic control, further influencing the administration’s legislative path.

Investors, business leaders, and policymakers must carefully assess the broader economic and financial implications of either a unified Democratic government or a divided Congress. Financial markets, which initially priced in expectations of Democratic control, reflected this sentiment through a mild steepening of the yield curve, anticipating aggressive fiscal policy. Recent optimism surrounding a vaccine breakthrough has further fueled equity markets and driven bond yields higher.

Despite these shifts, RSM’s interest rate model indicates ample fiscal space to implement Biden’s policy priorities without triggering substantial interest rate risks. Although many variables remain uncertain, it is now possible to outline preliminary expectations for policy direction, economic performance, and financial market behavior under either full Democratic leadership or a continued era of divided government.

It’s essential to recognize that the rules set by both the House and Senate—particularly regarding the filibuster—will heavily influence the legislative possibilities and overall pace of change during the next two years.

Rules of the game

The legislative rules governing political interaction in the House of Representatives and the Senate will be critical in determining the scope of economic and social changes under a Biden administration.

Majority rule typically drives legislative decisions. However, the Senate’s filibuster rule has historically served as a powerful tool to slow or block significant initiatives. If the filibuster remains intact, it will significantly restrict the breadth of reforms that President Biden and congressional Democrats aim to pursue. Under current Senate procedures, most legislation requires a 60-vote supermajority to advance under regular order, unlike the specialized reconciliation process, which allows specific tax and spending measures to pass with a simple majority.

Should the Senate move to eliminate the filibuster, the pathway for substantial economic and social policy changes would widen considerably. Without the filibuster, the minority party would have limited ability to block sweeping reforms, creating a significant inflection point early in a unified Democratic government.

Conversely, if the Republican Party retains control of the Senate, the prospect of eliminating the filibuster becomes irrelevant. In such a divided government scenario, significant economic and social initiatives would likely be stalled, maintaining the status quo.

The following analysis explores the key policy priorities a Biden administration could implement if Democrats gain Senate control. If not, investors, business leaders, and policymakers should prepare for a period characterized by continuing resolutions, executive actions, and regulatory changes until the 2022 midterm elections.

Financial markets, expansionary fiscal policy, and interest rates

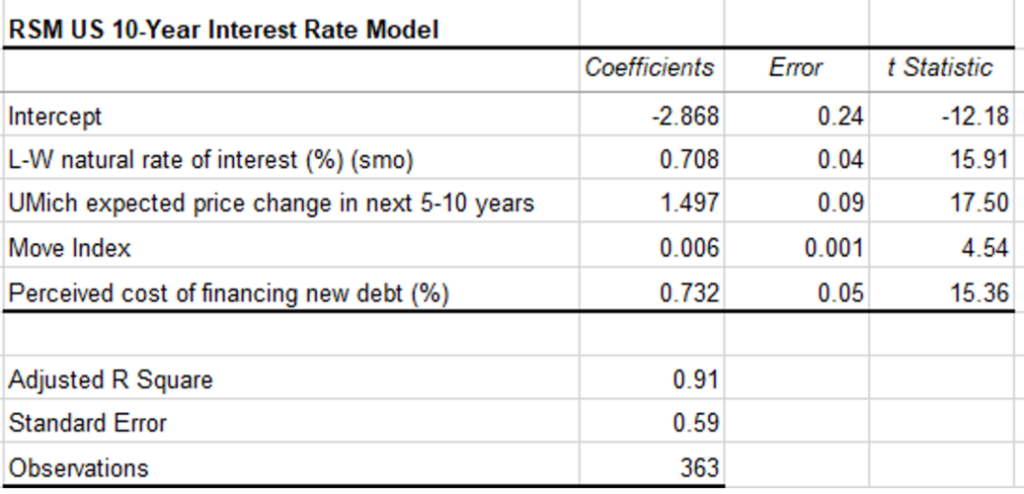

Over the past two decades, the American economy has experienced a profound structural transformation, particularly in the wake of the global financial crisis. According to our long-term interest rate model, the United States now possesses substantial fiscal capacity to implement comprehensive economic reforms. This includes the potential for a large-scale, multidecade infrastructure initiative aimed at modernizing the nation’s economic foundations.

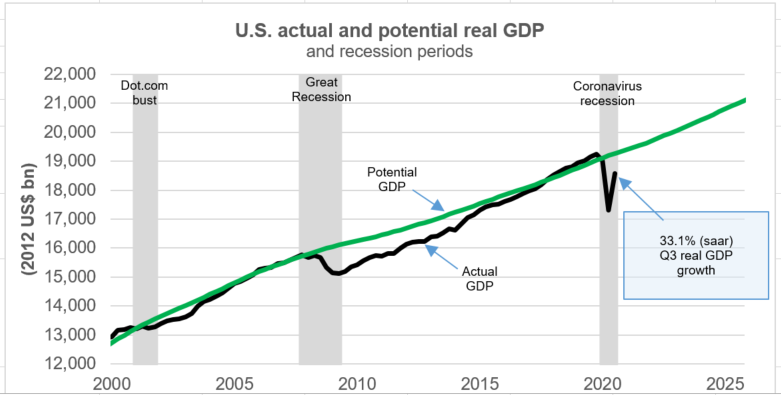

Guided by the Federal Reserve’s commitment to maintaining short-term interest rates near zero and our analysis of the key factors influencing long-term rates, the data clearly highlights the need to focus on narrowing the gap between actual and potential economic growth—a gap widened significantly by the pandemic.

Given this environment, the likelihood of a sharp rise in interest rates or an interest-rate shock disrupting the issuance of U.S. government securities remains very low. As a result, the Biden administration has substantial fiscal and policy space to implement initiatives aimed at closing the growth gap and boosting productivity across the medium to long term.

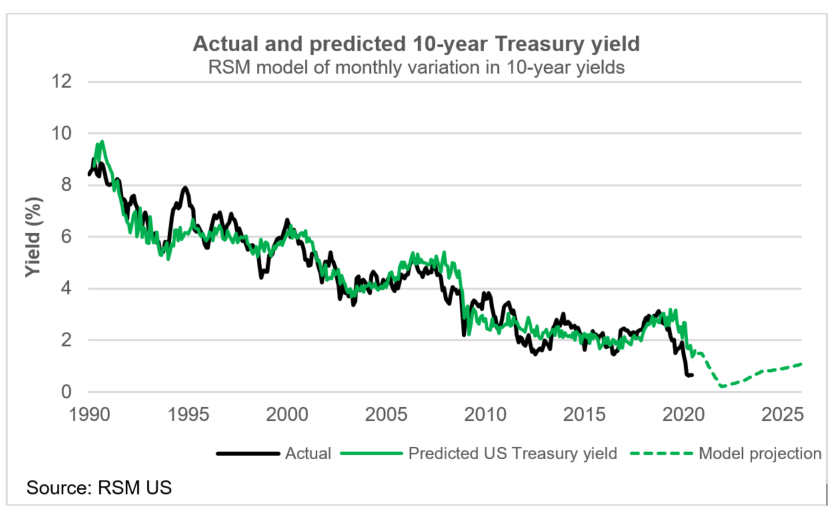

Our RSM model of 10-year Treasury bond yields projects continued downward pressure through the end of 2020, with yields expected to remain below 1% through 2025. This outlook holds, pending an anticipated post-election boost in fiscal aid, stimulus measures, and infrastructure spending, which could push yields modestly higher.

This projection aligns with Bloomberg’s forward curve matrix, which estimates a 1.28% yield on the 10-year Treasury by 2025. Markets have priced in a near-zero federal policy rate through that period, suggesting a slightly steeper yield curve under a Biden administration. Such a dynamic could enhance net interest margins for banks, encourage greater risk-taking within the financial sector, and ultimately stimulate economic growth—helping to narrow the gap between actual and potential output.

However, if fiscal stimulus and investment initiatives fall short, 10-year yields are likely to remain suppressed around current levels, ranging from 0.5% to 0.7%, with the risk of even lower rates.

The pandemic’s shock to the global economy has already triggered historically low investment levels and muted expectations for inflation and growth. Without significant policy action aimed at boosting productivity, U.S. GDP growth, currently at 1.8%, could decline to around 1.5% over the next two decades.

Our interest rate models suggest that, given current economic conditions, debt accumulation no longer presents the outsized risks to the economic outlook once feared. The threat of an interest-rate shock, runaway inflation, or sharply lower growth appears significantly reduced compared to earlier expectations. As a result, the United States has ample fiscal space to pursue necessary policy changes aimed at boosting productivity and driving long-term economic growth.

Order of operations: Pandemic, vaccine, and health care first

Drawing on insights from Washington insiders, the Biden administration’s initial agenda will prioritize four critical areas: pandemic containment, vaccine development, production, and distribution, bolstering the domestic healthcare system, and modernizing America’s aging infrastructure.

With over 10 million confirmed COVID-19 cases and more than 225,000 fatalities, public pressure will demand swift action on safe, equitable vaccine access and broader healthcare support from day one. We expect the administration to sustain these policy efforts until the pandemic subsides and ensure robust follow-up care is in place.

Central to the agenda is the Biden healthcare proposal, which seeks to expand the 2010 Affordable Care Act by raising subsidies for individual insurance purchases and introducing a public option. This public plan would directly compete with private insurers and automatically enroll eligible low-income households. The nonpartisan Committee for a Responsible Federal Budget pegs the cost at about $85 billion annually over the next decade—an estimate that may understate the actual expense given the pandemic’s scale and duration.

Public sentiment underscores that pandemic relief will eclipse all other priorities, setting the stage for a science-driven approach to public health and efforts to restore the credibility of the Centers for Disease Control and Prevention. Long-term policy success will hinge on seamlessly integrating these healthcare initiatives with the administration’s broader infrastructure and economic recovery goals.

Fiscal aid and stimulus

As the Biden administration takes office, we anticipate a significant surge in government spending, potentially reaching trillions of dollars, to mitigate the ongoing economic effects of the pandemic. In mid-2020, the House of Representatives passed a $3 trillion aid package, later trimmed to $2.4 trillion. With no additional fiscal relief passed before the election, we now expect a new round of stimulus, potentially $2 trillion, to be introduced during the lame-duck session of Congress or early in the new year. This initial package will likely focus on expanding unemployment benefits and allocating nearly $500 billion in aid to state and local governments.

In addition to pandemic relief, Biden’s “Build Back Better” plan is expected to fuel further spending across various sectors. Over the next decade, this ambitious initiative includes $300 billion for research and development, $290 billion for Social Security, $1.9 trillion for education, $650 billion for housing, and additional investments in manufacturing and tax credits to stimulate job creation and economic growth.

Economic inequality and the minimum wage

As twenty major metropolitan areas move toward a $15-per-hour minimum wage, the Biden administration is expected to take swift action to address economic inequality. However, we believe this move will have minimal disruption to hours worked or a significant rise in unemployment.

The Democratic platform advocates for raising the national minimum wage to $15 by 2026—more than doubling the current rate of $7.25, which has remained unchanged since 2009. Given the pandemic-induced economic slowdown and current operations at roughly 80% capacity, any wage increase will likely be phased in, with adjustments based on overall economic conditions.

While economic theory suggests that higher wages can lead to reduced labor demand or fewer hours worked, past increases toward $15 in the pre-pandemic economy did not result in significant job losses or a decline in hours worked. As the economy continues to adapt, public sentiment on raising the minimum wage is evolving, reflecting the changing structure of the workforce and the need for economic recovery.

Rebuilding the future through an infrastructure bank

A Biden administration is expected to act swiftly to address the modernization of the nation’s aging infrastructure, some aspects of which are in dire need of overhaul. As part of the Build Back Better program, the administration would propose a $2 trillion investment over the next decade, with a particular focus on integrating technology. This comprehensive approach, which we term I2E, includes a big “I” for traditional infrastructure such as roads, bridges, ports, and waterways; little “i” for digital advancements like broadband, 5G, and other technological innovations; and “E” for green technologies designed to drive sustainability alongside modernization efforts.

Aside from pandemic relief, infrastructure reform could represent one of the most significant opportunities for the Biden administration. A well-executed infrastructure overhaul could generate long-term benefits, especially in an era when accurate interest rates are negative over a 10-year horizon. This allows the government to borrow at a low cost, repay less than it borrows, and enjoy medium—to long-term gains in productivity, employment, and economic growth.

It is also possible that a Biden administration, alongside a Democratic-controlled Congress, could establish an infrastructure bank that leverages America’s deep capital markets to amplify the federal government’s seed capital. This initiative would present significant opportunities for middle-market firms and could stimulate legislation benefiting the broader American population.

Taxes

It may seem surprising that taxes are not a higher priority in the Biden administration’s early policy agenda, especially considering the ongoing economic challenges. With the economy still operating roughly 20% below full capacity, implementing significant tax increases right away would be an inefficient strategy. While tax hikes are almost inevitable, it remains unclear whether these increases will be phased in or how comprehensive any potential tax reform will be.

Given the severe impact of the pandemic and the long-term damage to the labor market and service sectors, it’s unlikely that the current U.S. tax landscape will remain unchanged. The need to raise revenue will be essential to offset the deficit spending that escalated during the Trump administration and will likely continue under Biden’s leadership. The U.S. faces federal relief spending, state budget shortfalls, and pandemic uncertainties, all of which will contribute to the pressure to increase revenue. For a more detailed analysis of the Biden tax plan, please refer to insights from our RSM Washington national tax team.

Biden’s campaign has indicated plans to restore the top marginal tax rate to 39.6%, up from the current 37%. The proposal also includes eliminating the 20% exemption on unearned pass-through income and reintroducing a cap on itemized deductions via the Pease Limitation. Furthermore, Biden aims to increase revenue by applying a 12.4% Social Security tax to incomes over $400,000, extending the current tax cap of $137,700. Businesses, regardless of size or structure, should carefully assess how these proposed tax changes could impact their operations and cash flow moving forward.

Trade

The past four years have been marked by a series of trade wars, but we expect these to end as the Biden administration works to restore diplomatic and trade relations across North America, Europe, and Asia. A key part of this effort is likely to be the revitalization of the Trans-Pacific Partnership (TPP), which includes countries responsible for 40% of global GDP and reinforces a multilateral trade framework.

As the global trade recovery begins, it will play a crucial role in the broader, long-term economic rebound. We anticipate a rollback of many of the tariffs imposed by the Trump administration on U.S. trade partners, although tariffs on China are likely to remain in place.

China was mentioned 22 times in the Democratic platform, signaling a bipartisan consensus on the need to address issues with Beijing. The U.S. re-entry into the TPP may be framed as a national security issue, strategically aligning the United States with its trade partners to counter China economically while setting aside other trade concerns for the moment. This approach would focus on limiting China’s influence in trade, finance, and global economics.

Under the Trump administration, the U.S. took a confrontational stance toward China through tariffs and administrative actions, aiming to extract concessions. This aggressive strategy contributed to a global manufacturing recession and pushed the U.S. into a manufacturing downturn just before the pandemic.

While the forum for addressing trade disputes may shift, core issues—such as intellectual property theft, currency manipulation, and cyber theft—will remain. These disputes are likely to transition to multilateral forums where the U.S. and its allies will work to constrain China’s actions. We also expect that human rights and regional security concerns will continue to emerge as areas of tension in U.S.-China relations in the coming years.

Federal Reserve

The Federal Reserve stands as the most influential economic institution in the global economy. U.S. presidents often seek to shape their direction through appointments to the 12-member Federal Open Market Committee (FOMC), which sets the course for monetary policy. Over the next four years, President Biden will have the opportunity to nominate new leaders for key positions, including the chair, vice chair, and vice chair for supervision.

Trump’s nomination of Judy Shelton for the Fed’s board is currently stalled in the Senate, creating additional openings for the Biden administration to influence the central bank’s makeup. Given the recent changes in the Fed’s policy framework, we anticipate that Biden’s picks will bring a dovish tilt to the central bank’s approach, with a focus on enhancing employment and preventing excessive risk-taking in the financial sector. This shift is likely to further prioritize economic stability and long-term growth during Biden’s tenure.

Expect major change

Over the next two years, we can expect significant economic reform focused on health care, infrastructure, and the largest fiscal expenditures since the Johnson administration of the 1960s—possibly even comparable to the Roosevelt administration’s efforts in 1933.

Given the current public sentiment, it seems unlikely that the U.S. will emerge from the pandemic without fundamentally rethinking its healthcare system and addressing the shrinking opportunities in traditional industrial sectors. The economy is swiftly shifting toward advanced manufacturing and service sector jobs, while an increasingly educated population is nearing a racial reckoning. This, combined with economic policy changes, will likely drive a parallel legislative agenda focused on civil rights, voter suppression, and police reform, shaping the next phase of the nation’s growth and social progress.

Frequently Asked Questions

What is the current outlook for the 2025 U.S. election?

Joe Biden is projected to win the 2025 election, though control of the Senate remains uncertain. This could impact policy direction and economic priorities.

How will the outcome of the Senate races affect Biden’s economic policies?

The party controlling the Senate will determine the extent of Biden’s proposed economic reforms, particularly in areas like infrastructure, health care, and fiscal policy.

What is the significance of a divided government for economic policy?

A divided government, with a Republican-controlled Senate and Democratic control of the executive branch, may limit Biden’s ability to implement aggressive fiscal and social policies, leading to more compromises.

What economic issues will the Biden administration prioritize in its first 100 days?

In its first 100 days, the Biden administration is expected to focus on addressing the pandemic, securing vaccine distribution, expanding health care, and modernizing infrastructure.

How might the economy recover if the Democrats control both the House and Senate?

If the Democrats control both chambers of Congress, we could see an expansionary fiscal policy, including significant spending on infrastructure and social programs, which could drive economic growth and employment.

Will the Biden administration raise taxes?

While tax increases are expected, they are likely to be phased in, particularly for higher-income individuals and corporations. However, the scale and timing of these changes depend on Senate control.

How could a Biden administration address the global economic situation?

A focus on rebuilding international trade relationships, mainly through revitalizing the Trans-Pacific Partnership (TPP), is expected. Trade policies may shift, especially toward countering China’s influence economically and politically.

Conclusion

As we look ahead to the 2025 U.S. election, the economic landscape remains deeply influenced by both the ongoing challenges of the pandemic and the uncertainty surrounding Senate control. While Joe Biden is projected to win the presidency, the balance of power in the Senate will play a crucial role in determining the scope and speed of his economic reforms. A Democratic-controlled Senate could pave the way for ambitious fiscal and social policies, including massive infrastructure investments, expanded health care, and targeted support for industries and workers affected by the pandemic.