As bBusinesses brace for upcoming tariff implementations; total inventories rose by 0.2% in February, following a 0.6% increase in January, according to the latest economic data. The pre-tariff inventory buildup reflects strategic stockpiling efforts across sectors, aiming to mitigate anticipated cost increases.

This front-loading of inventory purchases is expected to temporarily boost Q1 economic growth. However, analysts warn that a subsequent inventory retrenchment may offset this short-term gain, likely dragging down GDP growth in the following quarters as businesses normalize their stock levels.

Breaking it down by sector:

- Wholesale inventories climbed 0.3% in February, following a 0.8% jump in January.

- Industrial inventories saw a modest 0.1% increase month-over-month.

- Retail inventories also edged up by 0.1%, maintaining a steady pace after minimal change in January.

This data highlights ongoing shifts in supply chain strategy, with companies adapting to policy uncertainty by stockpiling goods ahead of trade barriers. As global trade tensions continue, inventory trends remain a key economic indicator to watch.

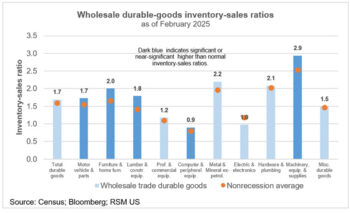

Inventory-sales ratios

The inventory-to-sales ratio offers a more standardized and insightful measure of how businesses are managing their stock relative to sales activity. In February, these ratios pointed to a continued trend of inventory accumulation, particularly among wholesalers of durable goods.

Notably, several key sectors experienced significant increases in their inventory-to-sales ratios, reflecting strategic stockpiling and slower sales turnover in specific categories. The most prominent rises were seen among wholesalers dealing in:

- Lumber and construction equipment

- Furniture and home furnishings

- Machinery and equipment supplies

- Computers and peripheral equipment

- Motor vehicle parts

These elevated ratios suggest that wholesalers are holding more inventory relative to sales, a trend that tariff concerns, supply chain disruptions, or anticipation of future demand may influence. As these patterns persist, the inventory-to-sales ratio remains a critical metric for evaluating market stability and sector-specific economic momentum.

In February, the inventory-to-sales ratios for wholesalers of most nondurable goods remained at or below historical averages, signaling balanced inventory levels across much of the sector. An exception was seen in alcoholic beverages, where ratios ticked above average, indicating a potential buildup in supply.

On the retail side, inventory-to-sales ratios continued to trend below average, reflecting efficient inventory turnover and cautious restocking amid shifting consumer demand.

Tariffs Expected to Push Housing Costs Higher

For consumers, newly imposed tariffs on Canadian exports—particularly lumber and construction equipment—are poised to drive up housing costs in the U.S. These materials play a critical role in residential construction. Any price increases will directly impact the housing component of the Consumer Price Index (CPI), which represents the most significant weight in the inflation measure.

Frequently Asked Question

Why did inventories rise in February 2025?

Inventories rose in February as businesses accelerated purchases to stay ahead of anticipated tariff increases, aiming to reduce future supply chain costs.

How much did total business inventories increase in February 2025?

Total business inventories increased by 0.2% in February, following a 0.6% rise in January, indicating a continued inventory buildup trend.

Which sectors experienced the most significant inventory increases?

Wholesale and retail sectors saw the most notable inventory growth, with wholesale inventories rising by 0.3% and retail inventories edging up by 0.1%.

What are inventory-to-sales ratios, and why are they important?

Inventory-to-sales ratios measure the amount of inventory businesses hold compared to their sales. They offer a standardized view of inventory efficiency and potential overstock risks.

Did nondurable goods follow the same inventory trend?

No, inventory-to-sales ratios for most nondurable goods remained near or below average, with alcoholic beverages being a key exception.

How do tariffs impact inventory decisions?

Tariffs encourage businesses to stockpile goods in advance, leading to short-term inventory surges to avoid higher costs once tariffs take effect.

What are the economic risks of inventory accumulation?

While short-term growth may rise, excessive inventory buildup can lead to future production pullbacks and GDP declines if demand slows.

Conclusion

The February inventory surge underscores how businesses are proactively responding to looming tariff pressures by accelerating purchases and building up stock. While this strategy may support short-term economic growth, it also sets the stage for a likely inventory correction and a potential drag on GDP in subsequent quarters.