Retail sales for March are projected to rise by more than 1%, according to expectations ahead of the U.S. Census Bureau’s official release on Thursday. This anticipated spike reflects a strategic shift in consumer behavior as households accelerate purchases to prepare for impending tariff increases.

One of the most notable drivers of this growth is the sharp jump in auto sales, which surged to a seasonally adjusted annual rate of 17.77 million, up from 16 million in the previous month. While this boost will significantly enhance the headline retail sales figure, it’s also likely to lead to a steep pullback in April as the early spending wave subsides.

This shift underscores changing consumer sentiment around actual income trends and future purchasing conditions. As tariffs begin to take effect, households appear to be adjusting their consumption patterns accordingly—front-loading discretionary spending in response to anticipated price hikes.

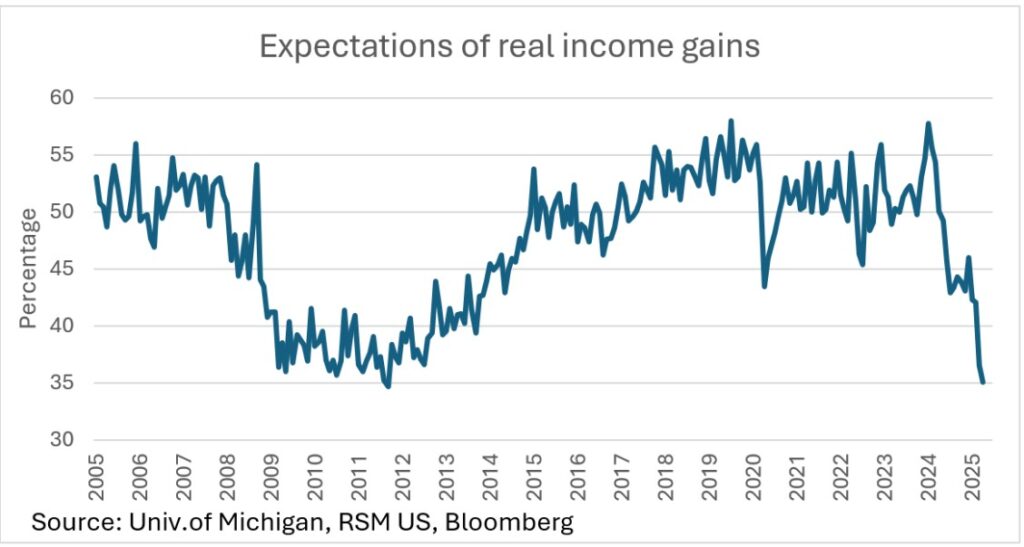

According to the latest University of Michigan consumer sentiment survey, only 35.1% of consumers anticipate real income growth over the next 12 months, continuing the downward trend in income expectations.

This declining optimism is closely tied to rising inflation expectations as consumers brace for the impact of trade-related tariffs. Analysts project inflation to accelerate by at least 1% to 1.5% within the next 90 days, driven by increased import costs and broader price pressures across essential goods.

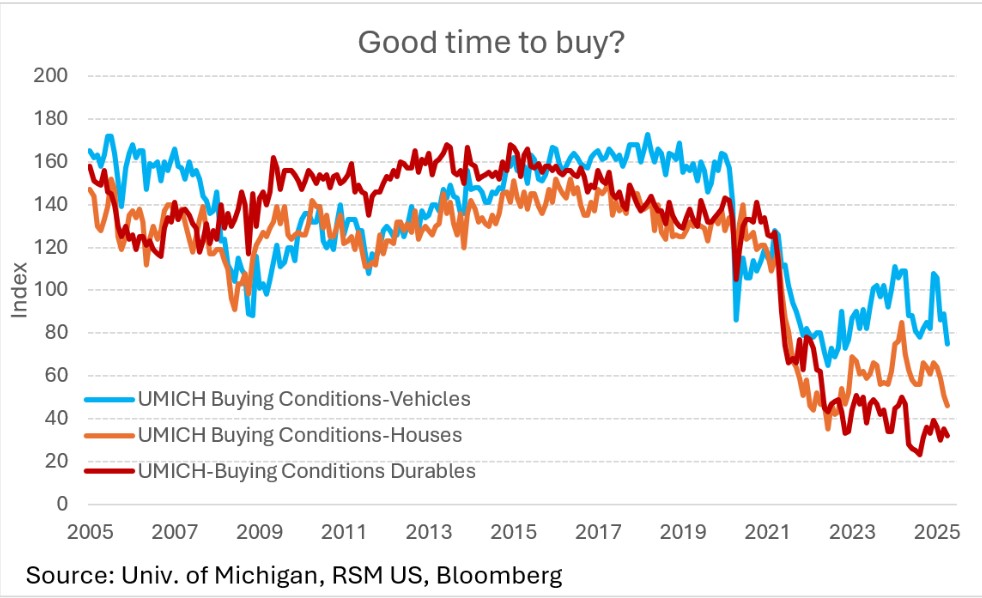

As inflation concerns rise and real income expectations decline, consumer sentiment around major purchases is deteriorating. According to the University of Michigan’s March survey, buying conditions for vehicles, homes, and consumer durables all posted notable declines.

This shift in perception reflects growing caution among households and carries broader implications. If this trend continues, it could lead to reduced household spending—a key driver of U.S. economic growth—potentially slowing momentum in the coming quarters.

Broad thoughts: It’s the uncertainty

Trade Uncertainty Weighs on Confidence, Spending, and Growth Prospects

The disruption of global trade relations may eventually yield benefits—more favorable agreements with key U.S. trading partners remain a real possibility. Encouraging signs suggest that some countries are open to renegotiating. However, the short-term impact of escalating tariffs is already taking a toll. Rising costs and supply chain pressures are pushing prices higher, with broader implications for economic growth.

What makes this environment particularly challenging is not just the tariff implementation itself but the extreme policy uncertainty. Rapid and unpredictable shifts in trade policy make it difficult for consumers, businesses, and investors to plan effectively. While markets can adapt to new rules, adaptation becomes nearly impossible when the rules are constantly changing.

Consumer Confidence Hit by Trade Volatility and Inflation Fears

In the consumer sector, this lack of policy clarity is significantly eroding confidence. Concerns over higher prices, weaker economic growth, and tightening personal finances are reducing both the capacity and willingness for discretionary spending. The uncertainty is also feeding into rising anxiety around the labor market, as an increasing number of layoff announcements heighten job security concerns.

Broader Impact Across Business and Investment Sectors

The fallout isn’t limited to consumers. Small business owners, corporate leaders, and institutional investors are also grappling with the challenges of interpreting and responding to rapid changes in the trade landscape. Making sound strategic or investment decisions becomes significantly more complicated in a climate where visibility is low and the trajectory of macroeconomic policy remains unclear.

There’s no way to predict precisely when conditions might improve. In the meantime, a close watch on key economic indicators—including inflation, GDP growth, and employment—will be essential. As financial conditions tighten, a further decline in consumer sentiment and a slowdown in household consumption are growing risks that could shape the broader economic outlook.

Important Disclosures and Data Sources

Past performance is not indicative of future results. All investments carry inherent risks, including the potential for loss of principal.

Data sources used for peer comparisons, performance returns, and statistical metrics are drawn from reputable third-party providers deemed reliable. However, not all data has been independently verified, and we make no guarantees regarding its accuracy or completeness. Non-factual statements herein represent current opinions only and are subject to change without notice. Market indices cited are for reference purposes only and are not directly investable.

This market commentary has been prepared by Plante Moran Financial Advisors (PMFA) to provide general insight into market trends. It is not intended as personal investment advice. The discussed investments or strategies may not be suitable for all investors. Please consult a PMFA advisor for guidance specific to your financial goals and risk tolerance.

Frequently Asked Question

What does it mean when real income expectations drop?

A decline in real income expectations means that fewer consumers believe their income will increase after adjusting for inflation over the next year. This shift often reflects economic uncertainty, rising prices, or concerns about job stability.

Why are real income expectations falling in 2025?

Real income expectations are falling due to rising inflation, tariff-related cost pressures, and slow wage growth. Consumers are adjusting their financial outlook in response to these economic headwinds.

How does declining consumer sentiment affect the economy?

When consumer sentiment weakens—particularly around income and spending power—it often leads to reduced consumer spending, which can slow economic growth since consumption is a significant component of GDP.

What role do inflation expectations play in consumer behavior?

Rising inflation expectations cause consumers to anticipate higher costs for goods and services, prompting some to cut back on spending or make early purchases, which distorts economic patterns.

How is the labor market influencing income expectations?

A softening labor market, including increased layoff announcements and slowed hiring, can reduce confidence in future income, pushing real income expectations lower.

Are big-ticket purchases affected by declining income expectations?

Yes, consumer willingness to spend on high-cost items like vehicles, homes, and appliances tends to decline when absolute income confidence drops, contributing to weaker retail and housing market performance.

What impact do trade policies have on income perceptions?

Trade tensions and tariff hikes raise the cost of imported goods, creating inflationary pressures that erode purchasing power and make consumers less optimistic about real income growth.

Conclusion

The sharp decline in real income expectations underscores growing consumer anxiety in the face of persistent inflation, evolving trade policies, and an increasingly uncertain economic outlook. With fewer households anticipating income gains and more cautious spending behavior on the rise, the ripple effects are likely to be felt across retail, housing, and broader consumption-driven sectors.