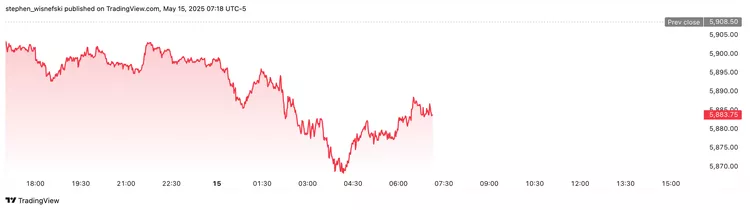

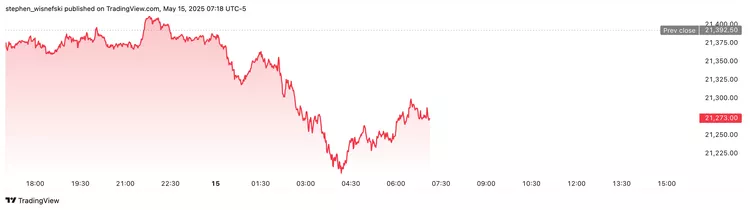

U.S. stock markets closed with mixed results on Thursday, May 15, 2025, as investors processed several influential earnings reports and a batch of closely watched economic data. The S&P 500 rose by 0.3%, marking its fourth straight day of gains and reinforcing bullish sentiment in the broader market. The Dow Jones Industrial Average gained 0.7%, breaking a short two-day losing streak. In contrast, the Nasdaq Composite declined 0.2%, halting a six-session winning streak fueled largely by a tech sector resurgence.

Investor mood was largely shaped by a combination of solid earnings performance and softer inflationary signals. Economic indicators released earlier in the day included April’s retail sales and weekly jobless claims, both of which aligned with analysts’ expectations. Meanwhile, the Producer Price Index (PPI), a key measure of wholesale inflation, delivered a surprise by showing a decline in prices last month—offering some relief amid ongoing concerns around inflation and its potential impact on interest rates, corporate margins, and consumer spending.

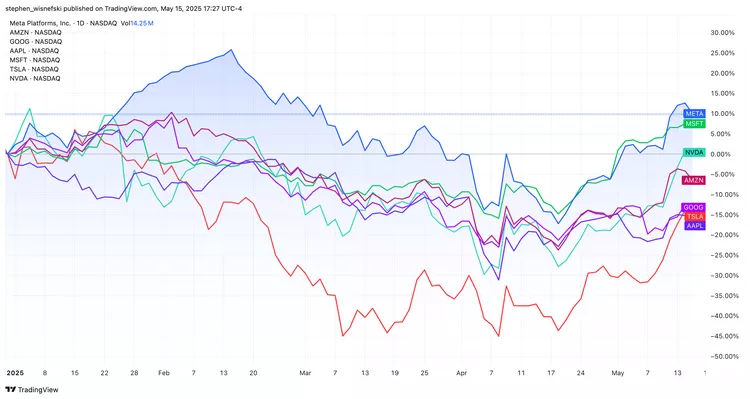

Technology stocks, which have been pivotal in driving recent market strength, lost momentum. Heavyweights such as Amazon (AMZN) and Meta Platforms (META) fell more than 2%. Meta faced added pressure late in the session following a report from The Wall Street Journal indicating delays in the release of its anticipated AI model. Other notable names including Apple (AAPL), Tesla (TSLA), Nvidia (NVDA), and Alphabet (GOOG) also ended the day lower. Microsoft (MSFT) and Broadcom (AVGO) managed to edge slightly higher, but their modest gains weren’t enough to support the Nasdaq.

In the retail sector, Walmart (WMT) closed 0.5% lower after recovering from a sharp early-session loss of 5%. The company reported a better-than-expected profit, but revenue came in just under analyst expectations. Nonetheless, Walmart maintained its full-year outlook, signaling management’s confidence in long-term performance.

UnitedHealth Group (UNH) suffered a dramatic drop of 11% after The Wall Street Journal revealed that the U.S. Department of Justice is conducting a criminal investigation into possible Medicare fraud involving the insurer. This comes on the heels of a tough week for UnitedHealth, which had already announced its CEO’s resignation and the suspension of its annual guidance. The stock now sits at its lowest level in five years.

Elsewhere in corporate earnings, Cisco Systems (CSCO) jumped nearly 5%, topping analyst expectations on both revenue and earnings. Deere & Company (DE) gained 4% and reached an all-time high following a robust quarterly report that highlighted strong demand for agricultural machinery. Conversely, Alibaba (BABA) plunged 7.5% after disappointing investors with lackluster quarterly performance, highlighting ongoing headwinds for the Chinese e-commerce sector.

In fixed income and commodities, the 10-year U.S. Treasury yield declined to 4.43%, falling from 4.53%—its highest point in nearly three months. The drop suggests some easing in long-term interest rate pressures. Meanwhile, the U.S. Dollar Index slipped 0.2% to 100.83, signaling modest weakness in the dollar relative to other major global currencies.

Gold prices saw a solid recovery, with gold futures climbing 1.7% to $3,245 an ounce, as investor interest in safe-haven assets returned amidst market uncertainty. Crude oil prices remained volatile, with West Texas Intermediate futures dropping 2.3% to settle at $61.70 per barrel, continuing a downward trend for the commodity amid mixed demand signals and global supply fluctuations.

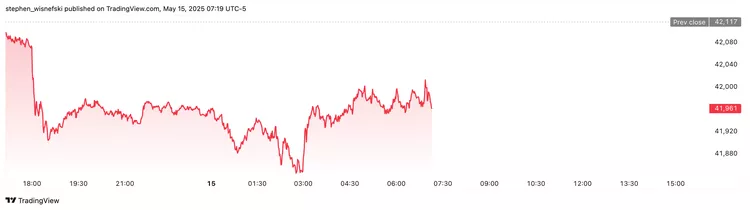

In cryptocurrency markets, Bitcoin (BTC) traded around $103,500 late in the session after dipping to an intraday low of $101,400. The leading digital asset has held above the $100,000 mark since breaching it last week, buoyed by growing institutional adoption and increasing market confidence in crypto as a long-term investment.

Biggest S&P 500 Movers on Thursday

Top Advancers in the S&P 500

Steris (STE) led S&P 500 gainers on Thursday, soaring 8.5% after the medical equipment manufacturer exceeded net income expectations in its fiscal fourth-quarter earnings. The company, known for its infection prevention and sterilization products, reported solid year-over-year revenue growth across all major segments, including health care, applied sterilization technology (AST), and life sciences, reinforcing its strong performance outlook.

While Walmart (WMT) shares faced selling pressure after its CFO warned that elevated tariffs could dent profitability, Dollar General (DG) surged 6.0%. The discount retailer benefitted from investor optimism, as analysts pointed out that value-focused chains like Dollar General and Dollar Tree (DLTR) may have more pricing flexibility amid a broader trend of rising retail prices. This potential edge could help such companies maintain margins even as inflation pressures persist.

HCA Healthcare (HCA) climbed 4.9% after Bank of America raised its price target and reiterated a “buy” rating on the stock. Analysts highlighted robust demand for HCA’s healthcare services and efficient cost management as key factors supporting the company’s upward trajectory. The bullish outlook reflects strong fundamentals in the broader hospital and healthcare services sector.

Biggest Decliners in the S&P 500

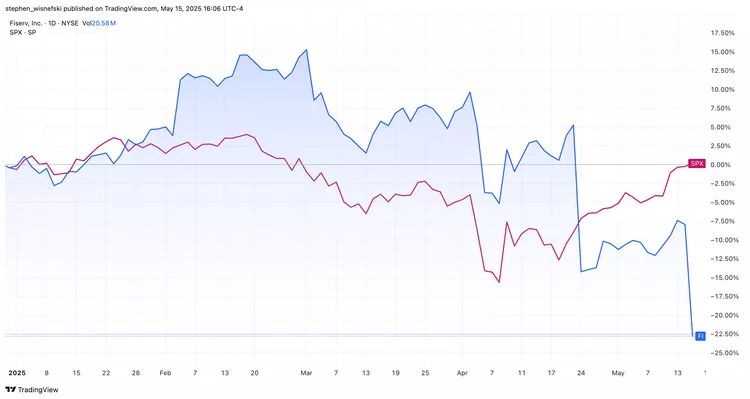

On the downside, Fiserv (FI) plummeted 16.2%, the steepest loss among all S&P 500 components. The sharp drop came after the company’s CFO stated that growth for its Clover point-of-sale platform is unlikely to improve in the current quarter. Much of Clover’s earlier success stemmed from client migration within Fiserv’s existing ecosystem—a trend executives acknowledged can’t be replicated going forward.

UnitedHealth Group (UNH) continued its slide, falling another 10.9% following reports that the U.S. Department of Justice is investigating the insurer for potential Medicare fraud. The decline adds to a difficult week for the healthcare giant, which already saw its CEO step down and its full-year 2025 guidance withdrawn, triggering heightened investor concern and heavy selling.

Shares of First Solar (FSLR) dropped 3.5%, pulling back after strong gains earlier in the week. The reversal followed excitement around a new Congressional proposal that appeared favorable for solar energy companies, particularly because it retained key tax credits. Although the legislative outlook remains generally positive, Thursday’s dip reflects some profit-taking amid ongoing policy uncertainty.

Applied Materials Stock Slides as China Sales Shrink

Applied Materials (AMAT) reported fiscal second-quarter results late Thursday that fell short of revenue expectations, driven primarily by a continued decline in sales from China, which pressured the stock in after-hours trading. Shares dropped more than 5% following the announcement.

The semiconductor equipment maker posted revenue of $7.1 billion, representing a 7% year-over-year increase but coming in below consensus estimates compiled by Visible Alpha. A sharp contraction in China revenue, which totaled $1.77 billion, marked a significant drop from $2.83 billion a year earlier. The segment now accounts for just 25% of total company sales, down from 43% during the same period last year. This marks the third consecutive quarter of annualized declines in China-related revenue, signaling ongoing geopolitical and regulatory headwinds for U.S. chip-related firms operating in the region.

Despite the revenue miss, Applied Materials beat profit forecasts. Adjusted net income rose to $1.94 billion, or $2.39 per share, from $1.74 billion, or $2.09 per share, in the year-ago quarter. The performance topped analyst estimates, reflecting stronger margins and operational efficiency across its core divisions.

Looking to the fiscal third quarter, the company guided for adjusted earnings per share of $2.15 to $2.55 and revenue between $6.7 billion and $7.2 billion—ranges that came in slightly above Wall Street forecasts at the midpoint. The outlook suggests cautious optimism as demand recovers across select global markets while China remains a question mark.

Prior to the earnings release, Applied Materials stock had gained approximately 8% year-to-date, outperforming some of its industry peers amid a broader rebound in semiconductor stocks. However, the after-hours dip highlights investor sensitivity to China exposure and the ongoing impact of export restrictions on sector growth.

Meta Reportedly Delaying Launch of AI Model

Meta Platforms (META) is reportedly delaying the launch of its highly anticipated “Behemoth” AI model, raising internal concerns about whether recent upgrades offer meaningful progress over previous versions. The setback highlights growing tension within Meta’s AI division as the company races to keep pace with rivals in the generative AI space.

According to a Wall Street Journal report published Thursday, Meta had originally aimed to unveil the next-generation Llama 4 large language model in April during LlamaCon, an AI developer event. However, that target date came and went without an official release, and the company has yet to announce a revised timeline.

The delay has reportedly triggered frustration among Meta’s senior leadership, who are now weighing potential management changes within the team overseeing its AI product group. The internal discord underscores the challenges Meta faces in delivering AI innovations that can compete with offerings from OpenAI, Google DeepMind, and other leaders in the space.

Meta declined to comment on the report when contacted by Investopedia.

The update follows the company’s announcement last month that it plans to significantly increase capital expenditures to between $64 billion and $72 billion this year. Much of that investment is aimed at expanding AI infrastructure and accelerating development of cutting-edge language models, signaling that Meta remains committed to AI leadership despite the recent setback.

Meta Platforms (META) shares dipped around 2% on Thursday, even as the stock remains one of the top performers among the Magnificent 7 tech stocks this year. Since the beginning of 2025, Meta has climbed 10%, outpacing gains from other major tech giants and signaling continued investor confidence despite short-term volatility.

Quantum, AI Stocks Are Some of The Most Shorted

AI stocks have reclaimed the spotlight on Wall Street, emerging as some of the market’s most actively traded and hotly debated assets. Renewed optimism across financial markets—driven by easing U.S.-China tensions, cooler inflation data, and a flurry of deal announcements from President Trump’s Middle East tour—has reignited investor risk appetite. The Cboe Volatility Index (VIX), often referred to as the “fear gauge,” dropped below 20 for the first time since March, signaling improved market sentiment.

Among the biggest beneficiaries of this renewed bullishness are AI powerhouses like Nvidia (NVDA), Palantir Technologies (PLTR), and Advanced Micro Devices (AMD). However, as valuations climb, so does skepticism. Many hedge funds and active traders are betting that the AI rally may not sustain, leading to a surge in short-selling activity.

A standout target is SoundHound AI (SOUN)—a company backed by Nvidia. According to S3 Partners, traders have built short positions totaling $1.2 billion, significantly outpacing the $340 million invested in long positions. The sharp imbalance reflects growing doubts about the company’s ability to maintain momentum.

Another heavily shorted name is Super Micro Computer (SMCI), which has seen its shares skyrocket nearly 40% this week amid a broader surge in AI-related equities. Yet, despite the explosive rally, short positions in Supermicro stock outweigh long positions by over $500 million, highlighting how speculative pressure is mounting even as demand for AI infrastructure stocks intensifies.

Quantum, AI Stocks Among Wall Street’s Favorite Short Targets

Active traders hold significantly larger short positions than long positions in these stocks.

| Company | Ticker | Long Value | Short Value | Difference | Short as Share of Long |

|---|---|---|---|---|---|

| Federal National Mortgage Assoc | FNMA | $8 | $194 | -$186 | 2,425% |

| James Hardie Industries PLC ADR | JHX | $58 | $519 | -$461 | 895% |

| Rigetti Computing Inc | RGTI | $149 | $796 | -$647 | 534% |

| SoundHound AI Inc | SOUN | $340 | $1,258 | -$918 | 370% |

| BigBear.ai Holdings Inc | BBAI | $58 | $212 | -$154 | 366% |

| Metsera Inc | MTSR | $65 | $230 | -$165 | 354% |

| Medical Properties Trust Inc | MPW | $307 | $870 | -$562 | 283% |

| Arbor Realty Trust Inc | ABR | $250 | $622 | -$372 | 249% |

| Plug Power Inc | PLUG | $105 | $239 | -$134 | 228% |

| IonQ Inc | IONQ | $630 | $1,432 | -$802 | 227% |

| Company | Ticker | Long Value | Short Value | Difference | Short as Share of Long |

|---|---|---|---|---|---|

| D-Wave Quantum Inc | QBTS | $264 | $596 | -$332 | 226% |

| Trump Media & Technology Group | DJT | $131 | $275 | -$144 | 210% |

| GameStop Corp | GME | $679 | $1,342 | -$662 | 198% |

| Choice Hotels Intl Inc | CHH | $412 | $809 | -$397 | 196% |

| Summit Therapeutics Inc | SMMT | $339 | $646 | -$307 | 191% |

| Hertz Global Holdings Inc | HTZ | $237 | $437 | -$200 | 184% |

| Lucid Group Inc | LCID | $521 | $956 | -$435 | 183% |

| AST SpaceMobile Inc | ASTS | $672 | $1,119 | -$448 | 167% |

| Marathon Digital Holdings Inc | MARA | $917 | $1,503 | -$586 | 164% |

| Joby Aviation Inc | JOBY | $297 | $472 | -$175 | 159% |

| Company | Ticker | Long Value | Short Value | Difference | Short as Share of Long |

|---|---|---|---|---|---|

| Cleanspark Inc | CLSK | $558 | $862 | -$305 | 154% |

| Symbotic Inc | SYM | $307 | $462 | -$155 | 150% |

| NIO Inc ADR | NIO | $618 | $893 | -$275 | 145% |

| Super Micro Computer Inc | SMCI | $3,092 | $3,611 | -$519 | 117% |

| Rivian Automotive Inc | RIVN | $2,047 | $2,198 | -$150 | 107% |

SoundHound AI and Super Micro Computer exhibit a stronger bias toward short selling compared to most stocks. However, relative to their market size, these two companies still enjoy more bullish support than some other popular names. For example, Rigetti Computing (RGTI) faces an overwhelming short interest, with traders holding five times more short positions than long. Similarly, quantum computing firms like IonQ (IONQ) and D-Wave Quantum (QBTS) have short-to-long ratios exceeding 2:1, indicating notable bearish sentiment.

Other stocks where short positions nearly double the long bets include Plug Power (PLUG), Trump Media & Technology (DJT), and GameStop (GME), reflecting ongoing skepticism among active traders despite recent volatility.

Fiserve Plunges as CFO Says Clover Growth to Remain Flat

Shares of Fiserv (FI) plunged more than 16% on Thursday after CFO Robert Hau indicated that volume growth for the company’s Clover point-of-sale system is expected to remain steady this quarter, mirroring first-quarter performance. The sharp decline made Fiserv the worst-performing stock on the S&P 500 for the day. Since last month’s earnings report, which showed Clover volume growth slowed to 8% year-over-year from 14% in Q4 2024, Fiserv shares have dropped over 27%, reflecting investor concerns about the platform’s growth momentum.

At a JPMorgan event Thursday, Fiserv CFO Robert Hau stated that Clover’s growth is expected to be “generally similar” this quarter, according to a transcript from AlphaSense. Hau explained that part of the previous growth stemmed from converting existing Fiserv clients to the Clover gateway platform last year—a one-time shift that won’t repeat in 2025.

“So we had a gateway that was non-Clover for clients that we converted over to the Clover Gateway… that doesn’t repeat this year,” Hau said, adding that this gateway transition headwind is expected to intensify in the current quarter.

Hau’s comments follow last week’s announcement of Michael Lyons, former PNC President, as Fiserv’s new CEO. The outgoing CEO, Frank Bisignano, recently joined the Trump administration as commissioner of the Social Security Administration after Senate confirmation.

UnitedHealth Stock Headed for Worst Month Ever

Shares of UnitedHealth Group (UNH) plunged by double digits for the second time this week on Thursday, amid reports of a possible Medicare fraud investigation targeting the company. This latest drop pushed the stock down more than 50% over the past month, marking its steepest decline since going public in 1984 and trading at its lowest level in over five years.

The stock experienced a sharp 20% one-day decline last month following a lowered full-year profit forecast. On Tuesday, shares tumbled another 18% after UnitedHealth withdrew its earnings outlook entirely and announced the unexpected departure of its CEO.

On Thursday, UnitedHealth shares were down 11% in after-hours trading after earlier falling as much as 19% during the session, reflecting continued investor concerns.

Analysts See Nike as Winner in Dick’s-Foot Locker Deal

Wall Street analysts view Nike (NKE) as a major winner from Dick’s Sporting Goods (DKS) acquiring Foot Locker (FL) in a deal valued at approximately $2.4 billion.

Jefferies analysts highlighted that a more efficiently managed Foot Locker under Dick’s ownership, combined with a cleaner retail landscape and strong innovation, should accelerate Nike’s recovery. “With shares still below COVID lows, we see buying opportunities at current levels,” they noted ahead of the deal confirmation.

The analysts emphasized that Foot Locker’s operations could improve significantly under the stewardship of Dick’s, while also strengthening Nike’s already solid relationship with Dick’s. This synergy is expected to boost Nike’s retail presence and enhance brand consistency across both retailers.

Nike currently accounts for at least half of Foot Locker’s sales and is the top contributor to Dick’s footwear revenue, according to Jefferies. UBS analysts estimate that post-merger, Nike could represent around 30% to 35% of Dick’s total sales, underscoring how closely the companies’ futures are now intertwined.

Oppenheimer analysts added that the combined Foot Locker and Dick’s Sporting Goods will form a more powerful distribution partner for Nike and other leading brands like Under Armour (UAA), positioning the retailers to capitalize on brand innovations.

Nike is undergoing a turnaround following a challenging 2024 that included a CEO change. Analysts have cautioned that the recovery will take time, but Foot Locker’s recent earnings report showed signs that Nike’s new designs are resonating well with customers, signaling progress in the turnaround effort.

Foot Locker Jumps 80% After Deal to Be Acquired by Dick’s

Shares of Foot Locker (FL) surged more than 80% after the footwear retailer agreed to be acquired by Dick’s Sporting Goods (DKS) in a multibillion-dollar deal. Meanwhile, Dick’s stock declined by roughly 15% following the announcement.

Under the terms of the agreement, Foot Locker shareholders can choose to receive $24 in cash per share or exchange their shares for 0.1168 shares of Dick’s common stock. The transaction, expected to close in the second half of 2025, values Foot Locker’s equity at about $2.4 billion, with an enterprise value near $2.5 billion.

The companies stated that the merger will allow Dick’s to expand its reach by leveraging Foot Locker’s complementary real estate portfolio, serving customers in new U.S. locations and entering international markets for the first time.

Foot Locker operates roughly 2,400 retail stores across 20 countries, including locations in North America, Europe, Asia, Australia, and New Zealand, along with licensed stores in Europe, the Middle East, and Asia.

This announcement confirms a report from The Wall Street Journal on Wednesday that the two companies were in active talks. The agreed deal price of $24 per share significantly exceeds Wall Street’s average price target of under $19, according to Visible Alpha data.

On Wednesday, Foot Locker shares closed at $12.87, while Dick’s Sporting Goods ended the day at $209.61.

Coinbase Drops as Crypto Exchange Discloses Data Breach

Shares of Coinbase Global (COIN) dropped Thursday following the company’s disclosure of a cyberattack in a recent regulatory filing.

On May 11, Coinbase revealed it received an email from an unknown threat actor claiming to have obtained information on certain customer accounts and internal company documents. The company explained the hacker appears to have paid multiple contractors or employees in support roles outside the U.S. to access internal systems and gather the data.

The threat actor demanded a ransom to prevent public disclosure of the information. Coinbase confirmed it has not paid the ransom and is cooperating with law enforcement as the investigation continues. The company anticipates the incident could result in costs between $180 million and $400 million for remediation and voluntary customer reimbursements.

While Coinbase assured that no passwords or customer funds were accessed, sensitive information such as names, addresses, phone numbers, email addresses, partial Social Security numbers, masked bank account details, and Coinbase account data — including balance snapshots and transaction history — may have been compromised.

Coinbase’s stock price remains roughly flat compared to the end of 2024, despite a volatile trading pattern. So far in 2025, the cryptocurrency exchange’s shares have closely tracked the performance of the S&P 500 index.

Shares fell about 4% in recent trading, after dropping more than 8% earlier in the session. However, the stock, nearly unchanged year-to-date, experienced a surge earlier this week following the announcement that Coinbase will be added to the S&P 500 starting next Monday.

Alibaba Stock Slides on Disappoint Earnings

Shares of Alibaba Group Holdings (BABA) dropped sharply Thursday after the e-commerce and cloud computing giant reported fiscal fourth-quarter results that missed expectations. The company cited slower Chinese consumer spending and heightened competition as key challenges impacting performance.

Alibaba posted adjusted earnings per share of 1.57 yuan ($0.22) for the quarter, with revenue rising 7% year-over-year to 236.5 billion yuan ($32.81 billion). Both figures fell short of analyst estimates from Visible Alpha.

Breaking down sales, Alibaba’s Chinese e-commerce unit, Taobao and Tmall Group, saw revenue increase 12% to RMB 71.08 billion. The Alibaba International Digital Commerce Group’s sales grew 22% to RMB 33.58 billion, while the Cloud Intelligence Group recorded an 18% rise to RMB 30.13 billion.

CFO Toby Xu expressed confidence in the company’s future, stating, “We remain confident in our business outlook and will continue to invest in our core businesses to strengthen our competitive advantages.”

Despite shares falling 8% in late-morning U.S. trading, Alibaba stock has gained 46% since the beginning of 2025.

Walmart Expects Tariffs Will Lead to Higher Prices

Walmart (WMT) CEO Doug McMillon stated during Thursday’s earnings call that the retailer will need to raise prices due to tariffs, despite recent reductions.

“We will do our best to keep our prices as low as possible, but given the magnitude of the tariffs, even at the reduced levels announced this week, we aren’t able to absorb all the pressure given the reality of narrow retail margins,” McMillon explained on the call.

The CEO added that Walmart, as the world’s largest retailer, is “positioned to manage the cost pressure from tariffs as well or better than anyone.” However, he acknowledged that even with the reduced tariff levels, higher costs will still lead to increased prices.

Walmart reported adjusted earnings per share (EPS) of $0.61, with revenue rising 2.5% to $165.61 billion. Analysts surveyed by Visible Alpha had expected EPS of $0.58 and revenue of $165.99 billion.

The company maintained its fiscal 2026 guidance and anticipates second-quarter net sales to grow between 3.5% and 4.5% in constant currency. In the previous quarter, Walmart projected 3% to 4% net sales growth from fiscal 2025’s $674.5 billion and adjusted EPS between $2.50 and $2.60, compared to $2.51 reported.

CFO John David Rainey explained, “Given the dynamic nature of the backdrop, and the wide and unpredictable range of near-term outcomes, we decided it was best not to provide a specific guidance range for operating income growth and EPS for the second quarter. Looking further ahead to the full year, we believe we can navigate successfully and meet our full-year guidance.”

Following the report, Walmart shares dropped about 2%, after rising in premarket trading. The stock had been up roughly 7% so far this year heading into the day.

UnitedHealth Stock Plunges on Report of DOJ Probe

Shares of UnitedHealth Group (UNH) plunged in early trading Thursday following reports that the U.S. Department of Justice is investigating the health insurer for potential criminal Medicare fraud.

According to people familiar with the matter, The Wall Street Journal reported that the DOJ’s criminal healthcare fraud unit is leading the probe, focusing specifically on UnitedHealth’s Medicare Advantage business. The investigation has reportedly been ongoing “since at least last summer,” targeting offenses like kickbacks that can lead to inflated Medicare or Medicaid payments.

This news arrives just two days after UnitedHealth shares fell 18% when CEO Andrew Witty stepped down and the company withdrew its 2025 financial outlook. So far this year, the stock has dropped nearly 40% heading into Thursday’s trading.

UnitedHealth Group denied the allegations, stating, “We have not been notified by the Department of Justice of the supposed criminal investigation reported, without official attribution, in the Wall Street Journal today.” The company also reaffirmed, “We stand by the integrity of our Medicare Advantage program.”

The DOJ has not yet responded to requests for comment.

UnitedHealth shares dropped 16% in recent trading, making it the biggest decliner on both the Dow and the S&P 500. The stock has fallen nearly 50% since the beginning of 2025.

Supermicro Levels to Watch Amid Stock’s Recent Surge

Shares of Super Micro Computer (SMCI) slipped in premarket trading after soaring Wednesday to their highest level since late February. The rally was fueled by a recent $20 billion partnership announced with Saudi Arabian data center company DataVolt, alongside similar deals from Nvidia (NVDA) and Advanced Micro Devices (AMD) as President Donald Trump began his four-day Middle East visit.

Investor sentiment also received a boost earlier this week when Raymond James dubbed Supermicro a “market leader in AI-optimized infrastructure,” highlighting the company’s strong position to expand its market share.

Supermicro’s stock has experienced a volatile stretch following a challenging period marked by several delayed filings that nearly led to a Nasdaq delisting. Despite this, the shares had bounced back 63% from their April lows by yesterday’s close. The stock surged 16% on Wednesday and has gained 40% over the past week.

Supermicro shares made a strong breakout above the upper trendline of a falling wedge pattern on Tuesday, with the price surging past the 200-day moving average during Wednesday’s session.

Notably, Wednesday’s rally came on the highest trading volume since late February, signaling strong buying interest from major market players. The relative strength index (RSI) also supports the bullish momentum, though it is approaching overbought territory, suggesting a higher chance of short-term pullbacks.

Investors should keep an eye on key resistance levels around $50 and $63, while watching support zones near $35 and $26.

In recent premarket trading, the stock dipped over 2% to $44.

Major Index Futures Point to Lower Open

Dow Jones Industrial Average futures fell 0.4%.

S&P 500 futures dropped 0.4% as well.

Nasdaq 100 futures declined by 0.6%.

Frequently Asked Question

What happened to the S&P 500 on May 15, 2025?

The S&P 500 continued its rally, extending gains amid positive investor sentiment and easing economic concerns.

Why did the Nasdaq’s winning streak end?

The Nasdaq 100 futures dropped 0.6%, ending its recent winning streak due to profit-taking and rotation into other sectors.

How did Dow Jones futures perform?

Dow Jones Industrial Average futures declined by 0.4% amid mixed corporate earnings and cautious market sentiment.

What sectors drove the S&P 500’s rally?

Technology and consumer discretionary sectors led the gains, fueled by strong earnings reports and upbeat economic data.

Were there any significant company earnings impacting the market?

Yes, earnings from major tech companies and retail giants influenced investor sentiment positively, contributing to the S&P 500 rally.

Did any geopolitical events affect the markets on this day?

No major geopolitical events directly impacted the markets on May 15, 2025, helping support steady investor confidence.

How did inflation data affect market performance?

Soft inflation data helped boost the S&P 500 rally by alleviating concerns about aggressive interest rate hikes.

Conclusion

The market on May 15, 2025, highlighted a continuing rally in the S&P 500, fueled by positive earnings and easing economic concerns, while the Nasdaq’s winning streak came to an end amid profit-taking and sector rotation. Despite mixed signals from futures and cautious investor sentiment, the broader market maintained resilience. Looking ahead, investors will closely monitor upcoming economic data, corporate earnings, and central bank actions to gauge whether the S&P 500’s momentum can sustain and if the Nasdaq can regain its footing. Overall, the market remains in a state of cautious optimism as it navigates through ongoing volatility and shifting dynamics.