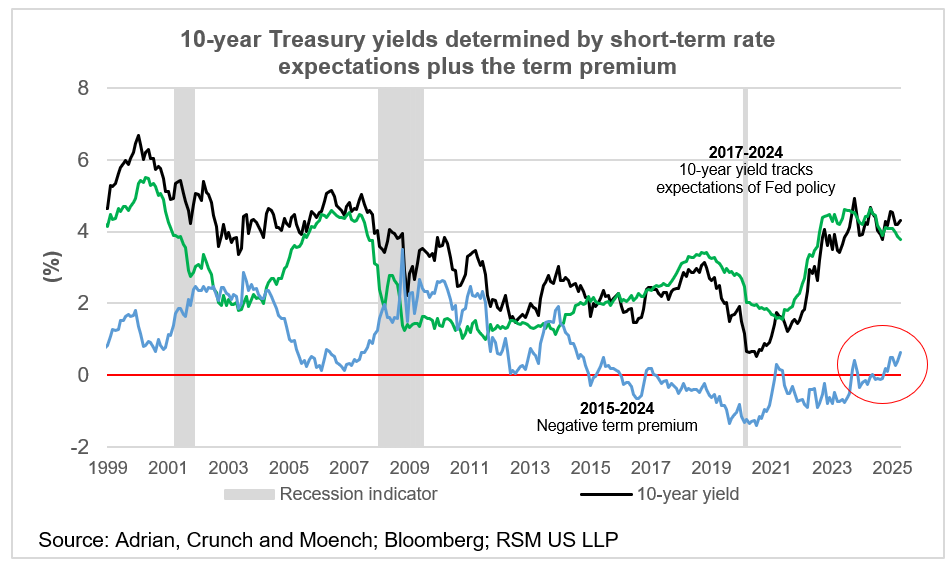

What began as a trade shock has now evolved into a broader financial shock, marked by a sharp rise in the term premium. Investors are actively unwinding risk and shifting away from dollar-denominated assets, triggering volatility in U.S. Treasury markets. This shift comes amid mounting concerns over the Federal Reserve’s independence, which appears increasingly at risk.

zSince bottoming out at a cyclical low of -0.33%, the term premium has surged to 0.64%—a near 1% increase. This sharp climb primarily reflects rising risk perceptions associated with holding U.S. Treasury securities, particularly those priced in dollars.

Adding to market pressures is the escalating concern over the Federal Reserve’s independence—a factor that continues to erode the appeal of U.S. Treasuries and the dollar as global reserve assets.

Although the recent turbulence from the unwinding of basis and swap trades has eased, markets now enter a more uncertain and risk-laden phase in the broader rollout of trade policy.

The uptick in real yields, inflation expectations, and the term premium underscores the mounting risk investors face in holding U.S. Treasuries. Compounding this are headline risks tied to questions around the Federal Reserve’s independence and the ongoing evolution of the trade war—factors that continue to shake investor confidence and hinder efforts to restore financial stability.

There is hope that a resolution can be reached—one that allows the Fed to refocus on stabilizing financial markets, while the administration shifts its policy agenda toward tax reform and regulatory initiatives.

What to watch this week: PMI flash readings amid tariff uncertainties

Investors are turning their attention to flash global Purchasing Managers’ Index (PMI) data this week, as they gauge the economic impact of escalating U.S. tariff tensions. Early indicators suggest a broad slowdown across both manufacturing and services sectors in major economies. In the U.S., manufacturing PMI is expected to slip into contraction territory at 49.3, down from 50.2, while services PMI is projected to ease to 52.9 from 54.5.

This pattern mirrors the 2018 U.S.-China tariff dispute, when global manufacturing PMIs fell below the critical 50-point mark, triggering sustained weakness in export-driven economies. However, the current round of tariffs could inflict deeper economic pain, given their wider scope and increased uncertainty. Much depends on whether markets view these tariffs as temporary—an increasingly optimistic stance in today’s environment.

On the corporate front, upcoming earnings reports from Tesla and Alphabet may provide crucial insight into company-level fallout. Tesla, with its extensive global manufacturing footprint and exposure to Chinese operations, faces elevated risk. Meanwhile, Alphabet could serve as a barometer for broader economic sentiment, particularly if advertisers begin to rein in spending amid macroeconomic softness.

Tesla in the epicenter of attention again

Tesla’s share price inched up yesterday, defying a weaker-than-expected earnings report that revealed significant shortfalls in both revenue and profit. The electric vehicle maker reported $19.3 billion in revenue—falling nearly 10% short of analysts’ forecasts of $21.4 billion. More concerning, earnings per share (EPS) came in at just $0.27, missing the expected $0.42 by a wide margin of 35.7%.

These figures reflect not only declining demand for Tesla vehicles but also deeper profitability issues. Despite the modest uptick in share price, Tesla stock remains 51% below its December 19 peak and has fallen 42% since the start of the year—a stark indicator of market sentiment.

Multiple headwinds continue to weigh on Tesla’s valuation. Intensifying competition from Chinese automakers like BYD, growing concerns over Tesla’s vehicle quality, and skepticism that rivals may soon outpace Tesla’s technological edge have all contributed to bearish sentiment. Additionally, CEO Elon Musk’s increasing involvement in political discourse has introduced further uncertainty.

One potential catalyst for the brief rebound in Tesla shares may have been Musk’s recent announcement that his time commitment to Dogecoin will “drop significantly” starting in May—perhaps easing investor concerns about distractions from core operations. Combined with a slight recovery in broader market sentiment, this could have temporarily supported the stock.

However, the fundamentals continue to exert downward pressure. Without a meaningful and sustained rally, Tesla’s stock remains entrenched in a bearish trend.

Frequently Asked Question

What is a term premium and why is it rising?

The term premium is the extra yield investors demand for holding long-term bonds instead of rolling over short-term debt. It’s rising due to increased uncertainty around U.S. fiscal and monetary policy, inflation expectations, and concerns over Federal Reserve independence.

How does a rising term premium affect Treasury markets?

A higher term premium typically leads to rising long-term bond yields, which can push down bond prices and increase borrowing costs across the economy.

Why are investors concerned about Federal Reserve independence?

Concerns have grown due to perceived political pressure on the Fed’s decision-making process. Any compromise to its independence could undermine investor confidence in U.S. monetary policy and destabilize financial markets.

How does Fed independence impact the term premium?

If investors believe the Fed may deviate from its inflation or interest rate mandates due to political influence, they may demand higher compensation (a higher term premium) to hold long-term debt.

What does the current term premium suggest about investor sentiment?

The rising term premium signals that investors are increasingly risk-averse and skeptical about the long-term stability of U.S. fiscal and monetary policy.

How high is the term premium right now?

The term premium has climbed from a cyclical low of -0.33% to approximately 0.64%—a nearly 1% increase, reflecting heightened risk aversion in global bond markets.

What role do inflation expectations play in the term premium?

Inflation expectations influence the term premium because long-term bonds are more sensitive to inflation risk. Higher expected inflation leads investors to demand greater yields, raising the term premium.

Conclusion

The sharp rise in the term premium serves as a clear signal that investors are growing increasingly uneasy about the long-term outlook for U.S. monetary policy. As confidence in the Federal Reserve’s independence comes under scrutiny, markets are pricing in greater risk for holding long-term Treasury securities. Combined with persistent inflation expectations and macroeconomic headwinds, this dynamic is reshaping the yield curve and tightening financial conditions.

While short-term fluctuations may offer brief relief, the broader trend points to a more volatile investment environment until clarity returns on the Fed’s autonomy and fiscal trajectory. For now, elevated risk premiums reflect not just technical market shifts—but deeper concerns about the future stability of U.S. policy leadership.