American consumers continued to rush ahead of tariff hikes in March, driving retail sales to their highest monthly gain since 2023.

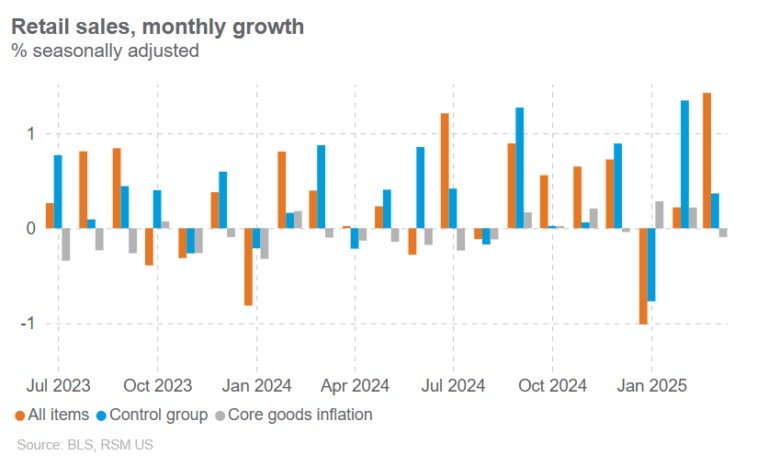

Retail sales surged by 1.4% in March, meeting high market expectations. The boost was mainly driven by robust demand for automobiles and construction materials, indicating a notable shift in consumer behavior as shoppers rushed to secure purchases before anticipated tariff increases.

Notably, the control group—excluding volatile items such as autos, gas, and building materials and providing a more accurate reflection of Gross Domestic Product (GDP)—also demonstrated strong growth.

The control group rose by 0.6% month-over-month and saw a 3.5% increase on a three-month annualized basis, signaling strong consumer demand and potentially offsetting concerns about weakening economic momentum.

Despite many forecasters revising their first-quarter GDP estimates into negative territory due to weak spending, March’s impressive retail performance may prompt some to reconsider those projections.

However, uncertainty remains: It’s unclear whether an uptick in imports balanced out the retail surge. March’s trade data—scheduled for release just one day before the first GDP estimate—will likely offer more insights.

Although consumer sentiment has fallen to multiyear lows amid growing concerns over trade policy, the decline in gasoline and commodity prices has helped cushion the blow. This has created space in household budgets for discretionary spending—for the time being.

Among the 13 categories, 11 saw month-over-month increases. Sporting goods rose by 2.4%, followed by restaurant sales, which grew by 1.8%. Electronics, clothing, and health & personal care also saw growth.

Yet, we believe this growth may be short-lived. With most new tariffs set to take effect in April and policy uncertainty still high, consumers may soon adopt a wait-and-see approach, scaling back on spending as risks continue to mount.

EXPORTS RISE MARGINALLY

Reaching a record high of $278.5 billion. Goods exports climbed by 0.7% to $183.2 billion, the highest since July 2022, driven by industrial supplies and materials, which rose by $2.2 billion due to increases in natural gas and non-monetary gold. Exports of automotive vehicles, parts, and engines grew by $1.2 billion. However, exports of capital goods fell by $1.5 billion, mainly due to a $1.8 billion drop in civilian aircraft shipments. As a result, the goods trade deficit expanded by 11.2%, hitting a record $163.5 billion in March.

Last week, the government reported that the trade deficit contributed to a record 4.83 percentage point drag on GDP in the previous quarter, causing the economy to contract at an annualized rate of 0.3%—the first decline since Q1 2022.

Former President Trump views tariffs as a means to generate revenue to fund his tax cuts and revitalize the U.S. industrial sector. Economists predict that the influx of imports will slow by May, potentially boosting GDP in the second quarter. However, they caution that a decline in exports could offset the boost from lower imports as other countries cut back on U.S. goods and travel. A decrease in U.S. visitors, particularly from Canada, has been linked to protests against tariffs, the immigration crackdown, and Trump’s controversial remarks about annexing Canada and Greenland.

Services exports fell by $0.9 billion to $95.2 billion in March, largely due to a $1.3 billion drop in travel.

The rush to beat tariffs led to record-high imports from countries including Mexico, the United Kingdom, Ireland, the Netherlands, Belgium, France, Germany, Italy, India, and Vietnam. However, imports from China hit their lowest levels since March 2020, during the initial wave of the COVID-19 pandemic. The seasonally adjusted goods trade deficit with China narrowed to $24.8 billion from $26.6 billion in February. The deficit with Canada also shrank to $4.9 billion from $7.4 billion in February, while the trade gap with Mexico remained relatively stable, and the surplus with the UK decreased.

“Imports from the EU were substantial in March, particularly from Ireland, and may decline in April,” said Veronica Clark, an economist at Citigroup. “However, imports from some Asian countries could rise further as the larger 40%-50% tariffs were delayed until July.”

Frequently Asked Question

Why did U.S. retail sales increase in March?

Retail sales in March surged by 1.4%, mainly due to consumers rushing to make purchases ahead of expected tariff hikes, especially in sectors like autos and construction materials.

How did consumer behavior change due to tariffs?

Consumers increased their spending on goods that were anticipated to be affected by tariffs, such as automobiles and building materials, to avoid higher prices in the future.

What is the control group in retail sales data?

The control group excludes volatile items such as autos, gasoline, and building materials. It is considered a more accurate gauge of consumer spending and economic growth, and it showed impressive growth in March.

What role did tariffs play in boosting retail sales?

The threat of higher tariffs prompted consumers to front-run price hikes by making purchases earlier than planned, thus driving up retail sales in March.

What products saw the most significant increases in retail sales?

Automobiles, construction materials, sporting goods, restaurant sales, and health & personal care items all saw significant increases in sales during March.

Will this surge in retail sales continue?

There is uncertainty. While the surge was driven by consumers trying to beat tariffs, the long-term impact may be limited by the implementation of tariffs in April and ongoing economic uncertainty.

How did retail sales in March compare to previous months?

Retail sales in March posted the highest monthly increase since 2023, indicating a strong surge driven by consumer anticipation of tariffs.

Conclusion

U.S. retail sales experienced a remarkable surge in March as consumers rushed to make purchases ahead of looming tariff hikes. The 1.4% increase in retail sales highlighted a shift in consumer behavior, particularly in sectors like automobiles and construction materials, as buyers sought to lock in prices before anticipated tariff-induced price hikes. This strong performance, especially in the control group, which reflects core consumer spending, helped ease concerns about an economic slowdown.