As market volatility defines 2025, top-performing exchange-traded funds (ETFs) such as SPY (S&P 500), QQQ (Nasdaq-100), IWM (Russell 2000), and DIA (Dow Jones Industrial Average) continue to serve as essential indicators of U.S. economic momentum and investor sentiment. With shifting trade policies, persistent inflation pressures, and rapid tech innovation reshaping the financial landscape, this in-depth analysis explores recent ETF performance, key market metrics, and headline news impacting investor behavior. Powered by AI-driven insights from Tickeron’s Financial Learning Models (FLMs), we present a data-centric forecast to guide investment strategies through the rest of 2025.

Recent Performance: A Tale of Recovery and Divergence

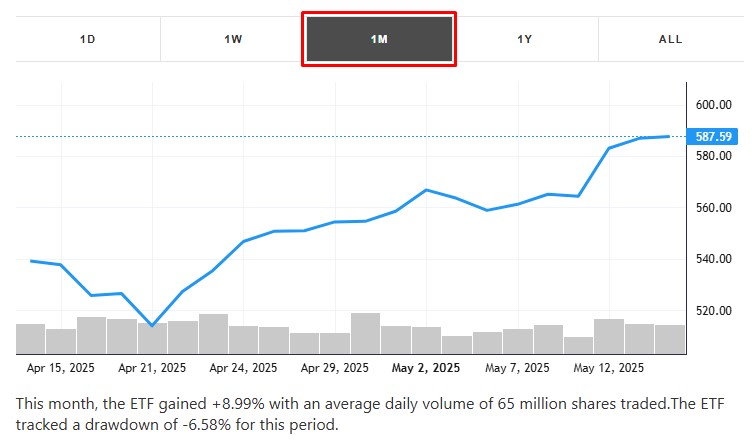

SPY (S&P 500 ETF)

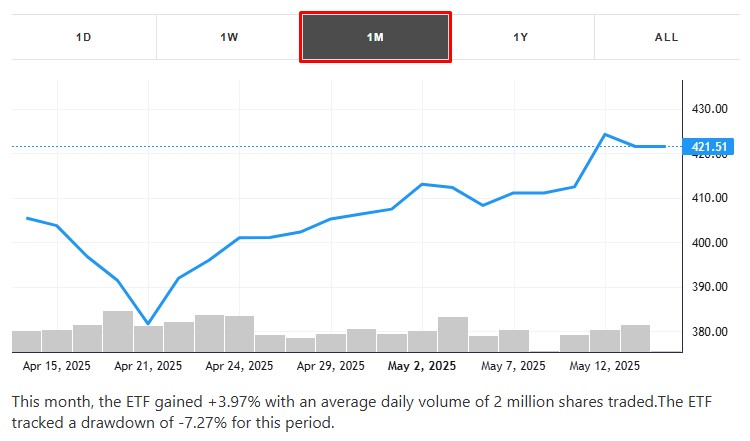

The SPY ETF, which mirrors the S&P 500 Index, has faced significant turbulence in 2025. Following a steep 19% drop from its February highs—triggered by President Trump’s “Liberation Day” tariff declarations in April—the market staged a strong comeback. As of May 13, 2025, the S&P 500 closed at 5,886.55, gaining 0.72% on the day and recovering its year-to-date losses.

A breakthrough U.S.-China tariff reduction agreement on May 12 ignited a 3.26% surge, marking the largest single-day gain in over a month. However, by May 15, S&P 500 futures declined 0.5%, suggesting market fatigue following a 22% rally from April lows.

According to Yahoo Finance, SPY is now up 2.5% year-to-date, with a 12-month return of 18.7%, reflecting both the resilience and ongoing uncertainty in the broader market.

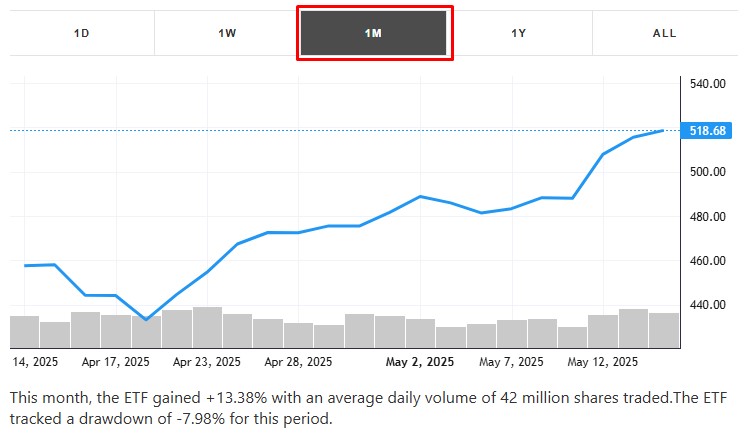

QQQ (Nasdaq-100 ETF)

The QQQ ETF, tracking the Nasdaq-100 Index, has outpaced broader markets in 2025, fueled by sustained gains in artificial intelligence and semiconductor stocks. On May 13, the Nasdaq-100 officially entered bull market territory, climbing 20% from its April lows, with QQQ closing at 19,010.08, a 1.61% daily increase.

Despite enduring a sharp 23% correction earlier in the year, QQQ has staged an aggressive recovery. A notable 4.35% rally on May 12 reflected renewed investor confidence in tech leadership. As of mid-May, QQQ remains down 3.1% year-to-date, yet boasts an impressive 12-month return of 22.4%, according to Nasdaq data.

Market sentiment has also been positive across social platforms. On X (formerly Twitter), popular account @prospero_ai observed that QQQ continues to trade in a “green zone,” signaling ongoing bullish momentum.

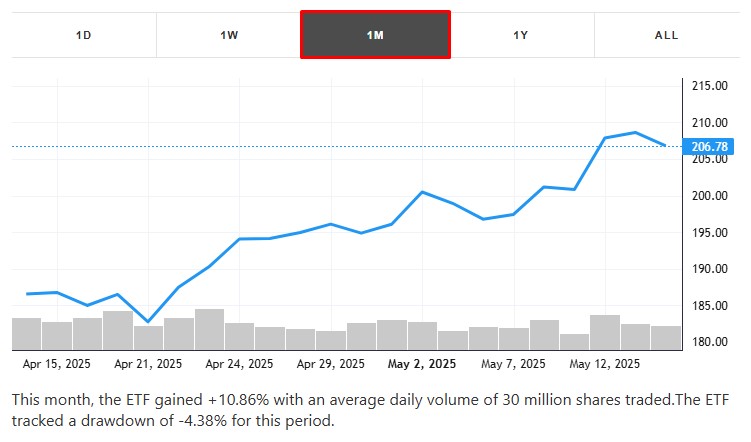

IWM (Russell 2000 ETF)

The IWM ETF, which tracks the Russell 2000 Index of small-cap stocks, has underperformed in 2025 amid growing concerns over economic slowdown. On April 30, IWM dropped 1.7% in premarket trading following news of a 2.7% GDP contraction in Q1 2025—the first negative growth reading since 2022.

Year-to-date, IWM is down 5.2%, while its 12-month return stands at 12.3%, according to Russell Investments data. The underperformance reflects small caps’ heightened sensitivity to interest rate volatility and shifting U.S. trade policy, both of which have weighed heavily on investor sentiment in the sector.

DIA (Dow Jones Industrial Average ETF)

The DIA ETF, which tracks the Dow Jones Industrial Average, has experienced mixed performance in 2025, impacted by sector-specific pressures—particularly in healthcare. On May 13, the Dow slipped 0.64%, closing at 42,140.43, mainly due to a sharp 18% drop in UnitedHealth shares.

Just a day earlier, on May 12, the index saw a strong rebound, surging 2.81%—a gain of over 1,161 points—driven by renewed optimism following tariff relief announcements. Despite the volatility, DIA remains down 3.2% year-to-date, though its 12-month return stands at 15.6%, according to Dow Jones data.

As of May 15, Dow futures declined 0.4%, signaling continued investor caution amid ongoing sector rotation and macroeconomic uncertainty.

Key Statistics and Metrics

ETF Volatility, Beta, and Correlation in 2025

Understanding how significant ETFs behave under current market conditions is critical for portfolio management. Below is a breakdown of realized volatility, beta values, and correlation coefficients based on Bloomberg data:

SPY – S&P 500 ETF

- 30-day realized volatility: 15.2%

- Beta: 1.00

- Correlation with Q: 0.92

Q – Nasdaq-100 ETF

30-day realized volatility: 18.7%

Beta: 1.15

Correlation with IWM: 0.78

IWM – Russell 2000 ETF

- 30-day realized volatility: 20.1%

- Beta: 1.25

- Correlation with DIA: 0.85

- Correlation with Q: 0.70

DIA – Dow Jones ETF

- 30-day realized volatility: 14.8%

- Beta: 0.95

- Correlation with SPY: 0.94

Dividend Yields and Expense Ratios (2025)

Investors often weigh dividend income and fund fees when selecting ETFs. Here’s how these four major funds compare:

SPY – S&P 500 ETF (SPDR)

- Dividend yield: 1.3%

- Expense ratio: 0.0945%

Q – Nasdaq-100 ETF (Invesco)

- Dividend yield: 0.6%

- Expense ratio: 0.20%

IWM – Russell 2000 ETF (iShares)

- Dividend yield: 1.8%

- Expense ratio: 0.19%

DIA – Dow Jones ETF (SPDR)

- Dividend yield: 1.6%

- Expense ratio: 0.16%

Top News Impacting Major Indices

Tariff Relief Rally

The U.S.-China agreement to temporarily reduce tariffs for 90 days, announced on May 11, 2025, ignited a significant market rally. On May 12, the S&P 500 surged 3.26%, while the Nasdaq jumped 4.35%, reflecting renewed investor optimism over easing trade war tensions.

The tariff relief was particularly beneficial for technology-focused sectors, boosting QQQ and consumer-driven segments and supporting gains in SPY and DIA. However, the IWM ETF, which tracks small-cap stocks, showed muted enthusiasm. Concerns about domestic economic weakness and sensitivity to interest rate shifts continue to weigh on small-cap sentiment.

By May 15, futures edged lower, signaling investor profit-taking and a more cautious outlook despite the temporary trade breakthrough.

Economic Contraction and Fed Policy

According to data released on April 30, the U.S. economy contracted by 2.7% in Q1 2025, putting pressure on IWM (Russell 2000) and DIA (Dow Jones). The weak GDP reading, coupled with the Federal Reserve’s May 7 statement highlighting persistent economic slowdown risks and sticky inflation—with CPI holding at 2.3%—has led to a sharp recalibration in market expectations.

As of mid-May, the probability of a June interest rate cut has dropped to 36.6%, based on CME FedWatch data. This hawkish outlook poses headwinds for small-cap growth (IWM), which is more vulnerable to higher borrowing costs and domestic economic fragility. Conversely, QQQ (Nasdaq-100) continues to benefit from investor rotation into resilient tech sectors, bolstered by strong fundamentals and AI-driven growth narratives.

Sector-Specific Shocks

On May 13, UnitedHealth’s shares tumbled 18% following the suspension of its 2025 earnings guidance, dragging both the DIA (Dow Jones ETF) and SPY (S&P 500 ETF) lower. Meanwhile, the tech sector continued to lead gains, as Nvidia’s strong rally propelled QQQ to a sixth consecutive day of advances on May 14, highlighting technology’s ongoing market dominance.

Adding to positive momentum, Coinbase was officially added to the S&P 500 on May 19, replacing Discover Financial Services. This landmark inclusion signaled growing crypto market integration within major U.S. equity benchmarks, further boosting investor sentiment across SPY and QQQ.

Social Media Sentiment

Recent posts on X highlight divergent investor sentiment. Analyst @prospero_ai cautions that the SPY rally faces potential risks, whereas QQQ continues to demonstrate relative strength. Meanwhile, @SebastinPatron3 has shared accurate SPY and QQQ market predictions, supporting strategic hedging approaches.

These insights align closely with Tickeron’s Double Agent signals, which integrate both bullish and bearish perspectives by leveraging inverse ETFs for balanced market positioning.

AI-Driven Insights: FLM’s Role in Market Analysis

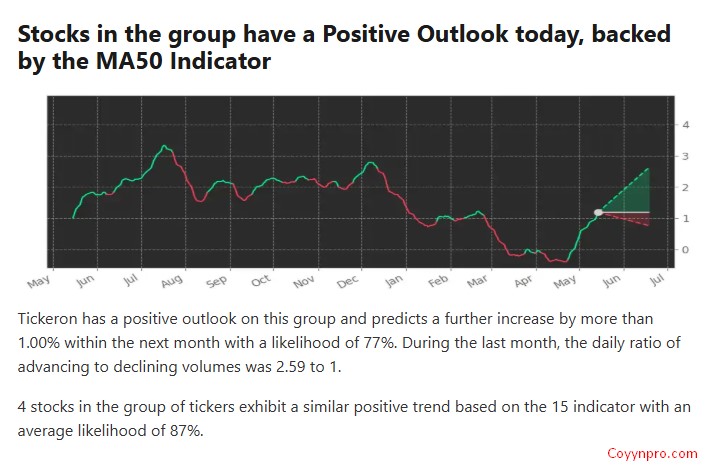

Financial Learning Models (FLMs) combine advanced artificial intelligence with traditional technical indicators to deliver enhanced market analysis. On May 14, AI Trading Agents accurately identified QQQ’s bullish momentum, reflected in its 0.7% daily gain.

Meanwhile, FLMs’ Double Agent strategies, which utilize inverse ETFs such as QID, correspond with social sentiment on X, highlighting SPY’s weakening momentum. These sophisticated tools have achieved win rates as high as 75% in QQQ/QID trades, equipping traders to effectively manage volatility during a turbulent 2025 shaped by trade tariff fluctuations and economic uncertainty.

Outlook for 2025

SPY: Cautious Optimism

SPY’s upward trajectory in 2025 relies heavily on sustained tariff relief and stable inflation levels. Analysts forecast the S&P 500 to trade between 5,900 and 6,100 by year-end, suggesting a modest upside of 0.2% to 3.5% from the May 13 closing price. The recent inclusion of Coinbase in the index could further boost investor sentiment, though ongoing healthcare sector volatility may limit overall gains.

Q: Tech-Led Growth

QQQ is positioned for substantial gains in 2025, propelled by robust AI advancements and soaring semiconductor demand. Wall Street analysts project the Nasdaq-100 to trade between 19,500 and 20,000, indicating a potential upside of 2.6% to 5.2%. Key drivers include Nvidia’s market leadership and Alphabet’s impressive 46% profit surge in Q1 2025, reinforcing optimism around tech sector growth. However, risks such as market overvaluation and the possibility of tariff tensions re-escalating could temper gains.

IWM: Small-Cap Struggles

IWM is encountering significant headwinds driven by elevated interest rates and ongoing economic contraction concerns. Analysts forecast the Russell 2000 to trade in the 2,000 to 2,100 range, reflecting a modest upside potential of 0% to 2%. However, a rebound in consumer spending fueled by tariff relief could offer a much-needed boost for small-cap stocks.

DIA: Steady but Vulnerable

DIA’s 2025 outlook appears stable, with the Dow Jones Industrial Average expected to trade between 42,500 and 43,500, implying a potential upside of 0.8% to 3.2%. While the financial and industrial sectors could gain from increased tariff clarity, ongoing headwinds in healthcare may restrain overall market advances.

Frequently Asked Questions

What is the 2025 forecast for SPY (S&P 500 ETF)?

Analysts expect SPY to trade between 5,900 and 6,100 by the end of 2025, with potential upside of 0.2% to 3.5%, driven by tariff relief and stable inflation.

How is QQQ (Nasdaq-100 ETF) expected to perform in 2025?

QQQ is projected to reach a range of 19,500 to 20,000, supported by strong AI innovation and semiconductor demand, with a possible upside of 2.6% to 5.2%.

What challenges does IWM (Russell 2000 ETF) face in 2025?

IWM faces headwinds from high interest rates and economic slowdown fears, with analysts forecasting a relatively flat performance, trading between 2,000 and 2,100.

What is the outlook for DIA (Dow Jones Industrial Average ETF) in 2025?

DIA is expected to trade between 42,500 and 43,500, offering a modest upside of 0.8% to 3.2%, though sector-specific risks, especially in healthcare, could limit gains.

How do tariffs impact SPY, QQQ, IWM, and DIA in 2025?

Tariff relief supports technology and consumer sectors (QQQ, SPY, DIA), but small-caps (IWM) remain cautious due to domestic economic concerns and sensitivity to policy changes.

What role does inflation play in the 2025 ETF market outlook?

Stable inflation, around 2.3% CPI, is crucial for maintaining positive ETF performance, influencing Federal Reserve rate decisions and investor sentiment.

How have recent market volatility and GDP data influenced ETF forecasts?

A 2.7% GDP contraction in Q1 2025 and ongoing volatility have pressured small-caps (IWM) and Dow sectors (DIA), while tech-focused QQQ remains resilient.

Conclusion

As 2025 unfolds amid economic uncertainty and evolving trade policies, ETFs like SPY, QQQ, IWM, and DIA remain vital benchmarks for U.S. market performance. SPY’s recovery hinges on continued tariff relief and inflation stability, offering modest upside potential. Meanwhile, QQQ stands out with strong growth prospects, fueled by AI innovation and semiconductor demand, despite valuation risks.